This article is also available in Japanese:日本語でも読めます

The electric mobility market has recently been booming in Kenya.

With an unstructured and almost nonexistent public transportation system, a strong portion of passenger transport is covered by moto taxi, also known as “Boda Boda”.

There are over 2 million motorcycles registered in Kenya alone. Estimates put the total number of registered motorcycles in the wider East African region at over 5 million. This segment is getting bigger and growing at 15%+.

It presents a large addressable market for electric mobility and has attracted a lot of attention and investment in Kenya.

A study by consulting firm Dalberg counted nearly 50 EV start-ups in Kenya. The biggest market is for motorcycles for public transport, followed by buses.

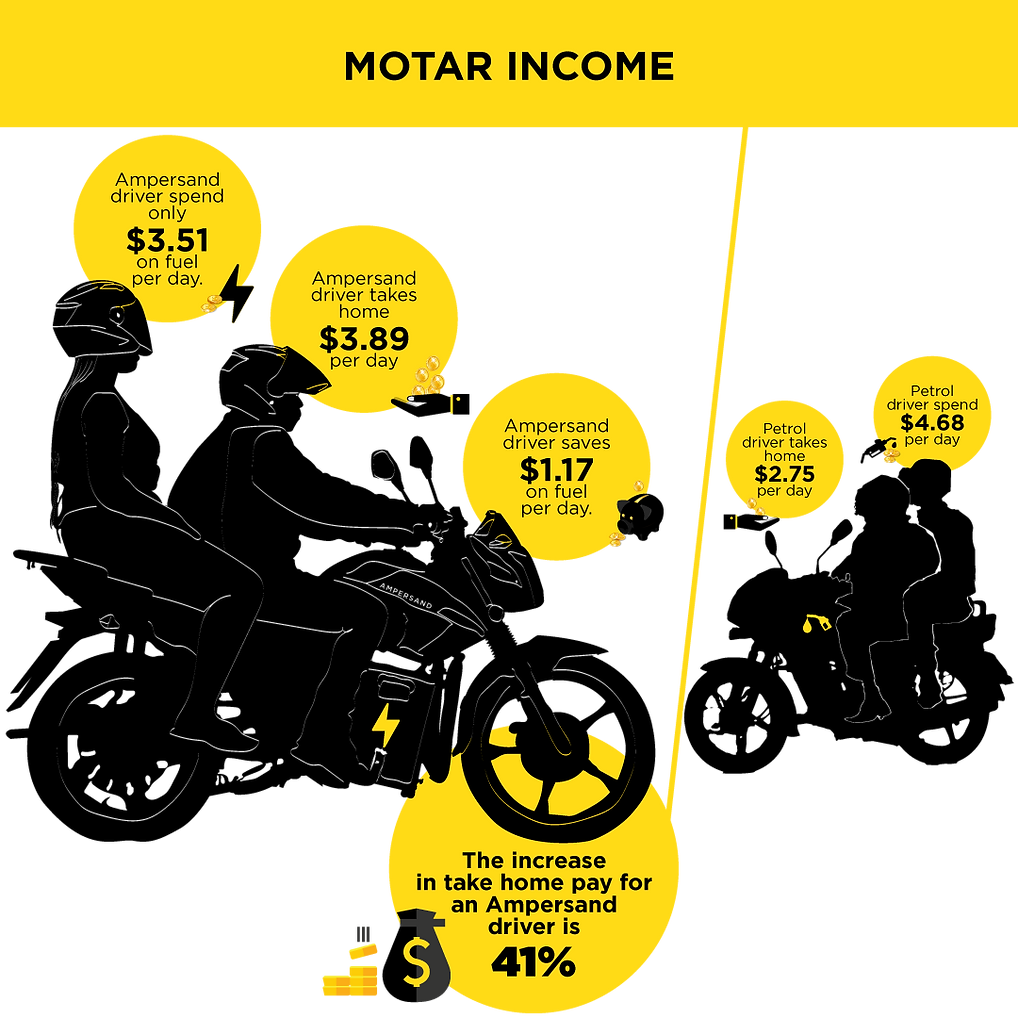

With limited subsidies on fuel and availability of renewable sources (solar, wind and in east Africa geothermal), it makes sense environmentally and economically (see below Ampersand’s comparison) to move to electric mobility.

There are however several issues to tackle including:

- Setting up a solid charging infrastructure to support the growing fleet of motorbikes being primarily used as taxis and where range anxiety is a clear showstopper for drivers

- Coming up with the right motorbike and battery product that can fit market demand and be assembled and maintained locally

- Solving the battery ownership model in a swapping / opened network model.

- Batteries age at very different speeds depending on driving behavior and charging/discharging cycles

- As experienced by Petroleum with LPG gas canisters, the “losses” of these assets can endanger the whole business. And canisters are far less valuable than Lithium-Ion Batteries.

Who are the key players for urban electric mobility?

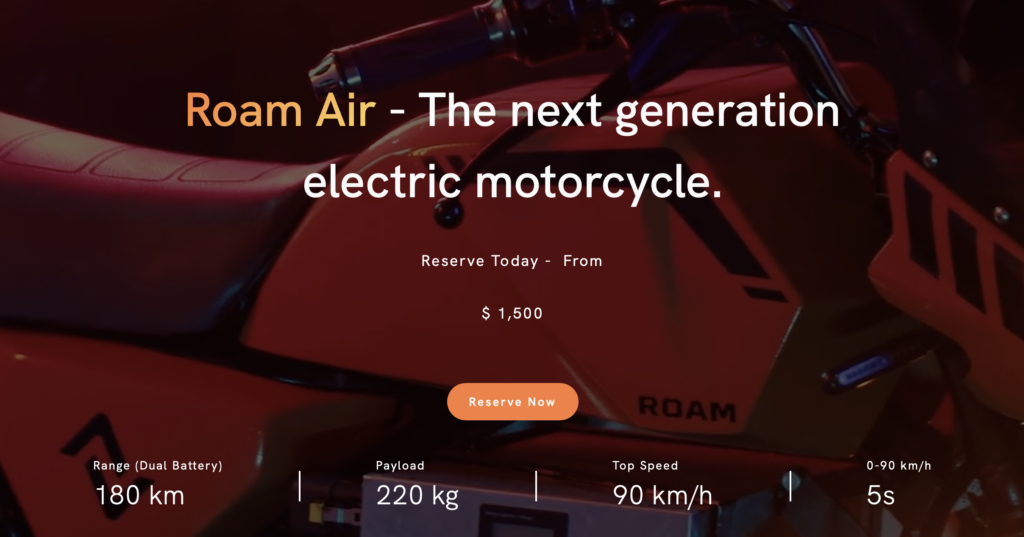

Roam / motorbikes

Roam, a Swedish-Kenyan company, founded in 2017, became the first company to deliver locally-produced electric motorcycles and buses. They are assembling their vehicles in Kenya (bikes and buses). With nearly 100 employees and sizable funding (7.5M$ in 2021), Roam is now the leading provider of electric vehicles in Africa.

Roam is focusing on commuters, i.e. motorbikes used from home to work by individuals, and are not yet tackling the bigger taxi market. Riders own the bikes as well as batteries and primarily recharge at home.

Roam will however set up a few battery rental stations in collaboration with TotalEnergies where drivers will be able to rent a battery to extend their journey. While being the leader, Roam has chosen not to pursue the battery-swapping model, leaving other players to crack it.

Stima / motorbikes

Stima is a French-Kenyan technology start-up started by 2 battery engineers started in 2021. Stima turned to India to find the right motorbike for Kenya and signed a partnership with One Electric. The bike has been adapted to the local market with a reinforced structure and a bigger battery.

Stima chose to own the batteries. To prevent theft and ensure that the batteries would only be recharged at the appropriate swapping stations, Stima developed a smart BMS with geofencing (automatic switch off beyond a certain area) and handshake with the charging system.

Following in the paths of successful deployment by CPOs (Charge Point Operators) in the electric car sector such as ChargePoint or EVBox, Stima decided to focus on fleets.

It has signed a partnership with the delivery company “Bolt food”. Their first swapping station is located close to one of the largest malls and restaurant complexs in Nairobi (Westgate Shopping mall).

They also have signed a partnership with the financial company Mogo to support riders to finance the vehicle. The financing is also secured by the partnership with “Bolt food” (logistic demand driven by the service)

This model ensures a “closed loop” model (I.e. batteries always return to the same charging point) and secures the financing of the bike.

Stima is still a young company but seems to have a solid platform and ecosystem of partners which should allow them to succeed.

Ampersand / motorbikes

Ampersand is originally a Rwandese startup focusing on affordable electric vehicles and charging systems for Boda drivers.

Ampersand has the longest track record in this field having operated in Kigali since 2019. It now operates 60 000 battery swaps per month with 5 battery swap stations.

It announced in mid-2022 its entry into the Kenyan market in a partnership with TotalEnergies. TotalEnergies will install three spare charging stations at its service stations to power batteries for electric motorcycles from the start-up.

Ampersand owns the batteries of the fleet, while the driver pays a monthly subscription fee and swapping fee for every battery swap.

Ampersand has spent the last 4 years developing a robust platform incorporating mobile money payments and refining the battery management system of its battery packs. It should allow Ampersand to track the batteries and control them remotely to control theft and ill-usage.

While Ampersand doesn’t communicate on the “lost” batteries or charging outside its network, we can assume that its platform and experience have allowed them to crack the model.

BasiGo

BasiGo recently raised $6.6 million from several investment firms, including Keiki Capital, Trucks Venture Capital, Novastar Ventures, and mobility54 to launch the first commercial deliveries of its electric buses in Kenya in January 2023.

Roam

Roam is also active on bus transit and recently introduced a 77-seat electric bus with a range of 360 km, assembled locally which can be recharged in two hours.

EIS Insight

While e-Mobility for bikes is a clear opportunity in East Africa, the market is still in its infancy and there are key challenges that need to be fixed for this industry to take off.

- Lack of standards with chargers, batteries, and vehicles leads to a lack of locally available spare parts and lower scale efficiencies industry-wide.

- Capacity building: Growing the capability of existing mechanics to support this new value chain and after-market.

- Lack of knowledge sharing in the industry leads to inefficiencies.

- E.g. several players have faced similar defects with the batteries imported from China which could have been easily avoided if the first player had shared the issue with the followers.

In that regard, we can see players like Roam or Ampersand pushing to structure the industry through organizations such as the Association for Electric Mobility and Development in Africa.

e-Mobility has already had a long history and gone through similar growth in Western Europe and the US for the automotive sector and the African industry could learn from this experience to overcome these challenges.