This article is also available in Japanese:日本語でも読めます

Carbon credits were created following the Kyoto Protocol in 1997. Under the Kyoto Protocol, developed countries committed to reducing their greenhouse gas (GHG) emissions. The Protocol provides for three flexible mechanisms, including the Clean Development Mechanism (CDM), which allows developed countries to invest in emission reduction projects in developing countries and earn Certified Emission Reductions (CERs) for each ton of carbon dioxide equivalent reduced. These credits can then be used by these developed countries to meet part of their own emission reduction targets.

Carbon credits offer a valuable financing opportunity for Africa, providing a mechanism to attract investment in sustainable projects. African countries can use carbon credit programs to finance renewable energy initiatives, reforestation projects and climate-resilient agricultural practices. These credits not only generate revenue, but also help reduce emissions. In addition, carbon credit financing fosters technology transfer, promotes economic development and enhances Africa’s position in the global green economy, creating a win-win scenario for both environmental sustainability and economic growth.

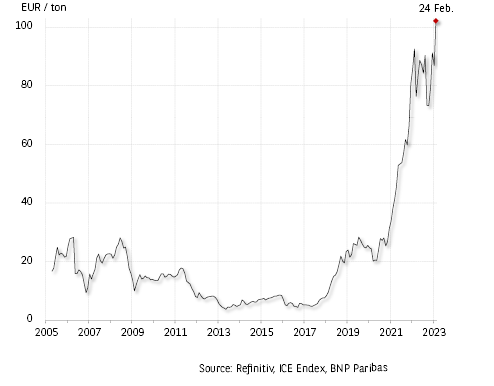

Given the recent increase in carbon credit prices, this could provide an incentive for further project development in Africa. Although several projects and companies have been developed in Africa, the African market is still a niche compared to its true potential.

This article explores the potential causes of this challenge in Africa by looking at recent trends in the carbon credit market, the steps for a project to sell carbon credits, and how carbon credits are actually helping the African community by examining real life cases. It finds that the diversity of carbon standards, credibility of carbon credits and the transaction costs are barriers to project development.

What are carbon credits?

Carbon credits address climate change and reduce greenhouse gas emissions. These credits represent a quantifiable reduction or removal of one tonne of carbon dioxide equivalent (CO2e) emissions from the atmosphere. These credits can then be bought and sold on carbon markets. As such, carbon credits are a market-driven mechanism that creates economic incentives to adopt environmentally friendly practices and reduce their impact on the climate.

Mandatory vs. voluntary market

Carbon credits can be traded on two different markets

- Mandatory carbon market: A market used by companies and governments that are legally required to offset their emissions. Countries participating in this market are signatories to the Kyoto Protocol.

- Voluntary carbon market: A market that is independent of the mandatory carbon credit market and in which companies or institutions can participate on a voluntary basis. The market is not constrained by regulations to offset their remaining emissions.

Recent advances in the carbon credit markets

The carbon credit market has grown steadily since its inception, reaching a transaction value of EUR 850 billion in 2022. The world’s largest carbon credit market is in Europe, with a significant presence from the EU ETS, a mandatory carbon credit market introduced in 2005, which accounts for 87% of global trading.

Japan has also developed a carbon market infrastructure and in October this year the Tokyo Stock Exchange launched trading in J-credits, a government-certified carbon credit.

Requirements to register, publish and sell carbon credits?

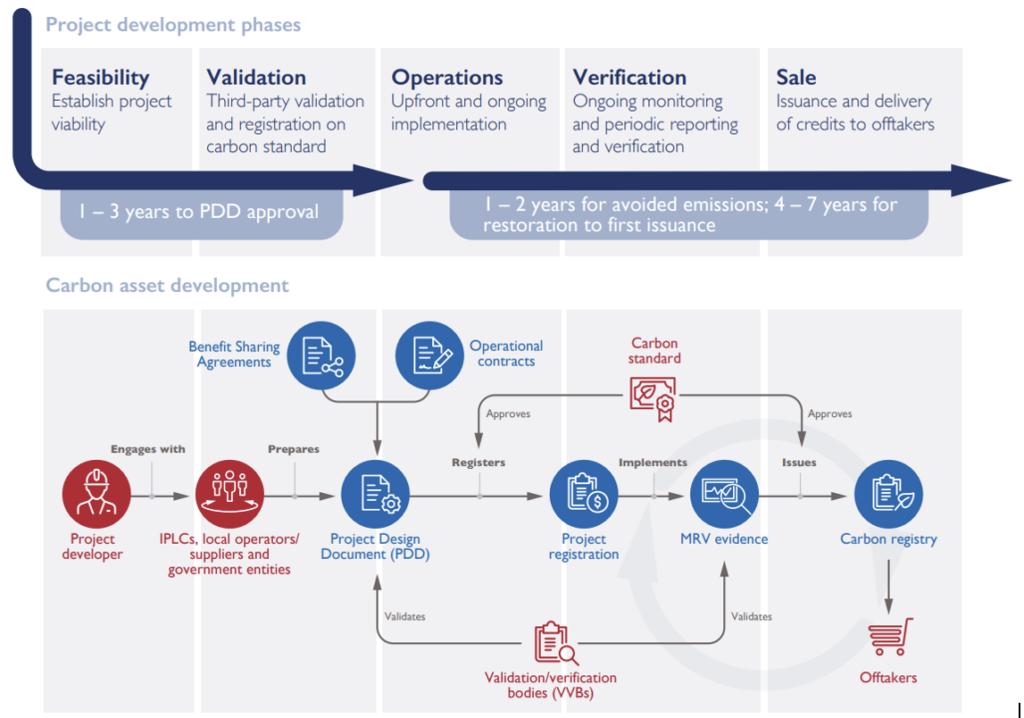

There are a total of five steps for a project to sell carbon credits and generate revenue;

- Identification of the project (Feasibility)

- Working with carbon credit standard (Validation)

- Project implementation (Operations)

- Monitoring and verification (Verification)

- Carbon credit issuance (Sales)

1. Identification of the project (Feasibility)

Projects can be divided into two categories;

①Emission removal: Projects that remove carbon from the atmosphere and sequester it in either biomass or rock over the long term.

②Emission avoidance: Projects that prevent the emission of greenhouse gases that would have been emitted under a business-as-usual scenario.

2. Working with carbon credit standards (Validation)

Carbon credit standards define the rules and requirements for project developers to register and verify their emission reduction projects. For example, the type of project, the methodology for measuring and reporting emissions are some of the components of the requirements. Standards are developed and managed by carbon standard bodies and will verify the project’s compliance with their emission criteria, and once a project is registered and verified, it will be issued with carbon credits.

Here are some examples of existing standards that carbon projects can work with;

3: Project implementation (Operations)

This is when the project is implemented by the project developers.

4. Monitoring and verification (Verification)

An independent third-party monitors and verifies the project to ensure it meets all the requirements of the chosen carbon credit standard. The verifier also checks the accuracy of the project report.

5. Carbon credit issuance (Sales)

Finally, carbon credits are issued and can be traded on the market.

In the voluntary carbon market, carbon credits can be sold in two markets

①Primary market: Over-the-counter, bilateral sales between project developers and off-takers.

②Secondary market: Purchase through brokers, traders or exchanges.

Exchanges have emerged, such as CBL (New York-based largest spot exchange for carbon credits) and ACX (AirCarbon Exchange) (Singapore-based exchange). Exchanges create standard products of carbon credits that guarantee the basic specifications of the credit. This makes it easier and quicker to trade carbon credits, which is preferred by traders and financial players buying carbon credits.

The potential of carbon credits for Africa

Carbon credits can contribute to the economic development for Africa. There are two potential ways to achieve economic development and improving people’s lives.

- Reducing the price of emission reducing products

The introduction of products such as cook stoves and water filters that can reduce the use of firewood and charcoal can contribute to economic development. Revenue from carbon credits can be used to reduce the price of using these alternative fuels by subsidising the installation costs and reducing the running costs of using the fuels. As a result, people will have access to cheap and ready-to-use energy that will enrich their daily lives and economic activities.

Below are some examples of how this system is being used;