This article is also available in Japanese:日本語でも読めます

The planet is on a path to curb its carbon emissions to limit the climate change impact following various agreements (Kyoto, Paris, etc). While a lot of emphases has been put on electric mobility based on batteries, a significant share of the planet’s energy future will depend on hydrogen. Several industries currently relying on fossil fuels will be dependent on Hydrogen to decarbonize. This will be true of air transport, maritime, rail (un-electrified networks), road transport as well as steel, cement production, chemical industry, heating, feedstock, long-term energy storage, etc.

Demand for hydrogen is already building up, especially for mobility-related industries as electrification of vehicles or tracks (railways) will not be the most efficient solution from an operation (range) or cost perspective (needed infrastructure). At Innotrans, the largest global railway industry show for instance H2 was getting all the attention with the top OEMs (Alstom, Siemens, CRRC, Stadler) but also smaller players (e.g. PESA) demonstrating the technology on site.

Alstom’s hydrogen train, especially, made its official commercial debut in northern Germany in August after 4 years of full-scale testing. A fleet of fourteen trains, supplied to the region of Lower Saxony, will gradually replace diesel locomotives on the hundred kilometers of the line.

A movement toward the introduction of green hydrogen

Governments are gearing up to support the development of hydrogen supply. 45 countries with Europe leading have developed hydrogen strategies to decarbonize their industry and pledged significant investments in this field.

In France, the government has planned to invest 7 billion euros to increase the annual production of carbon-free hydrogen to 700,000 tons (compared to 45,000 tons currently) by 2030. Germany is also pledging €7 billion ($7.7) to expand domestic green hydrogen pilots, but it also invests €2 billion ($2.2 billion) in hydrogen sourcing abroad through international partnerships. Japan, on the other hand, wants hydrogen and ammonia to make up 1% of both the primary energy mix and the electricity supply mix by 2030, under a Strategic Energy Plan passed in October 2021. The government also plans to spend at least $3.4 billion to accelerate research and marketing of hydrogen over the next decade, aiming for annual hydrogen demand of 20 million tons by 2050.

Hydrogen is also one of the key areas to reducing dependency on Russian natural gas. The EU has launched the REPowerEU program in march 2022 with a target of 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imports by 2030. However, to truly decarbonize the industry, the Hydrogen needs to be produced with renewables (e.g. Green Hydrogen) or by capturing the emissions (Blue Hydrogen) and most of the existing production capacity is for Hydrogen produced from fossil fuel (natural gas) or as a byproduct for carbonated industries (e.g. steel industries or refineries)

Green hydrogen production costs hindering the growth

Currently, hydrogen production from fossil fuels is the cheapest option in most parts of the world. Depending on regional gas prices, the levelized cost of producing hydrogen from natural gas ranges from $0.5 to $1.7 per kilogram (kg). Using Carbon Capture technologies (so-called blue hydrogen) to reduce CO2 emissions from hydrogen production brings the levelized production cost down to around $1-2 per kg. Using renewable power to produce hydrogen currently costs anything between US$3 to US$8 per kg.

How and where to produce green Hydrogen to meet targets

Technology needs to be improved to make the current processes more economically efficient.

- Electrolyzers: many well-funded startups (e.g. Verdagy, Lhyfe, Versogen, etc) have entered this space to optimize the technology and reduce its cost.

- New ways to produce hydrogen: e.g. waste or biomass gasification has gained a lot of traction with startups from around the globe (e.g. H2 Industries, Haffner Energy) are tackling the process to increase throughput and scale.

Even while integrating these technology improvements, remains the potential of renewable energy production at an affordable and efficient cost.

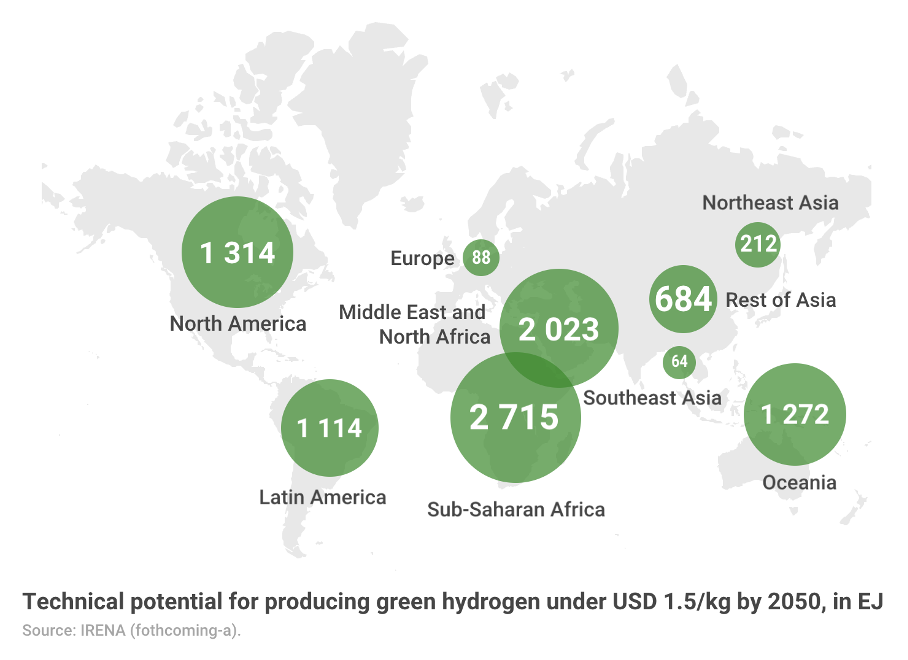

Per a recent IRENA report (see above), the capacity to produce green hydrogen at a competitive cost in EU & East Asia will dwarf the demand to replace diesel, fuel and kerosene. To cope with this gap (local supply vs. demand), we will see northern countries making deals to produce affordable and climate friendly hydrogen and ammonia in Africa. This is already starting with Germany, UK, France and Japan placing their pawns on the chessboard.

Planned projects / investments in Africa

- Hyphen, a German backed company, recently (11/21) announced a USD 9.4 Bn investment to build a large 300 000 tons of Green Hydrogen per year in Namibia

- Chariot Energy Group, a UK company, recently announced (06/22) a USD 3,5 Bn, 10GW project in Mauritania

- Germany’s H2-Industries has entered into an agreement with Egypt for a waste to energy to produce 300 000 tons of Hydrogen while disposing of 4 million tons of waste by investing USD 4 Bn

- France’s TotalEnergies, through its subsidiary Total Eren has pledged to develop a 30 000 tons of Green Hydrogen in Egypt.

- The German government developed its National Hydrogen Strategy with first signed agreements with Morocco in 2020 and more recently in Namibia as well with several pilot projects receiving direct German funding (08/22)

EIS Insights

- The Hydrogen revolution has already started, and commercial transport applications are already live as shown by the railway industry.

- There will be many opportunities in end user industries (transport, heavy industry, etc) in new production technologies (electrolyzis, biomass, etc) as well as in transport (from production geographies to users)

- Investing in sourcing will also be critical as the renewable resources to produce hydrogen cost effectively are unevenly distributed

- Africa and South America are key regions to achieve the targets with the right cost and carbon emissions and European countries are already securing access to these resources.

- As Anja Karliczek, the German Science Minister said, “There is already a race around the world for the best hydrogen technologies and the best locations for hydrogen production”. Corporates should quickly invest in or at least investigate the potential for Hydrogen production in these regions.